Levered Free Cash Flow Formula Net Income

LFCF EBITDA Mandatory Debt Payments Change in Net. Since the free cash flow to equity pertains only to equity holders we must use the equity value in the denominator to match the represented stakeholders.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

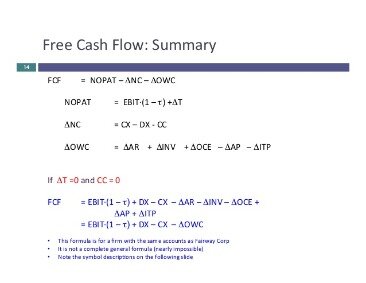

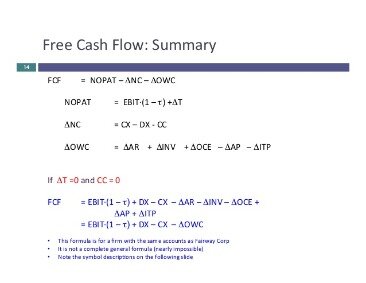

EBIT Operating income income statement t tax rate computed by dividing income taxes by EBIT.

Levered free cash flow formula net income. Unlevered Free Cash Flow Formula Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Unlevered free cash flow is the amount of cash a company has prior to making its debt payments. Free Cash Flow to Equity FCFE.

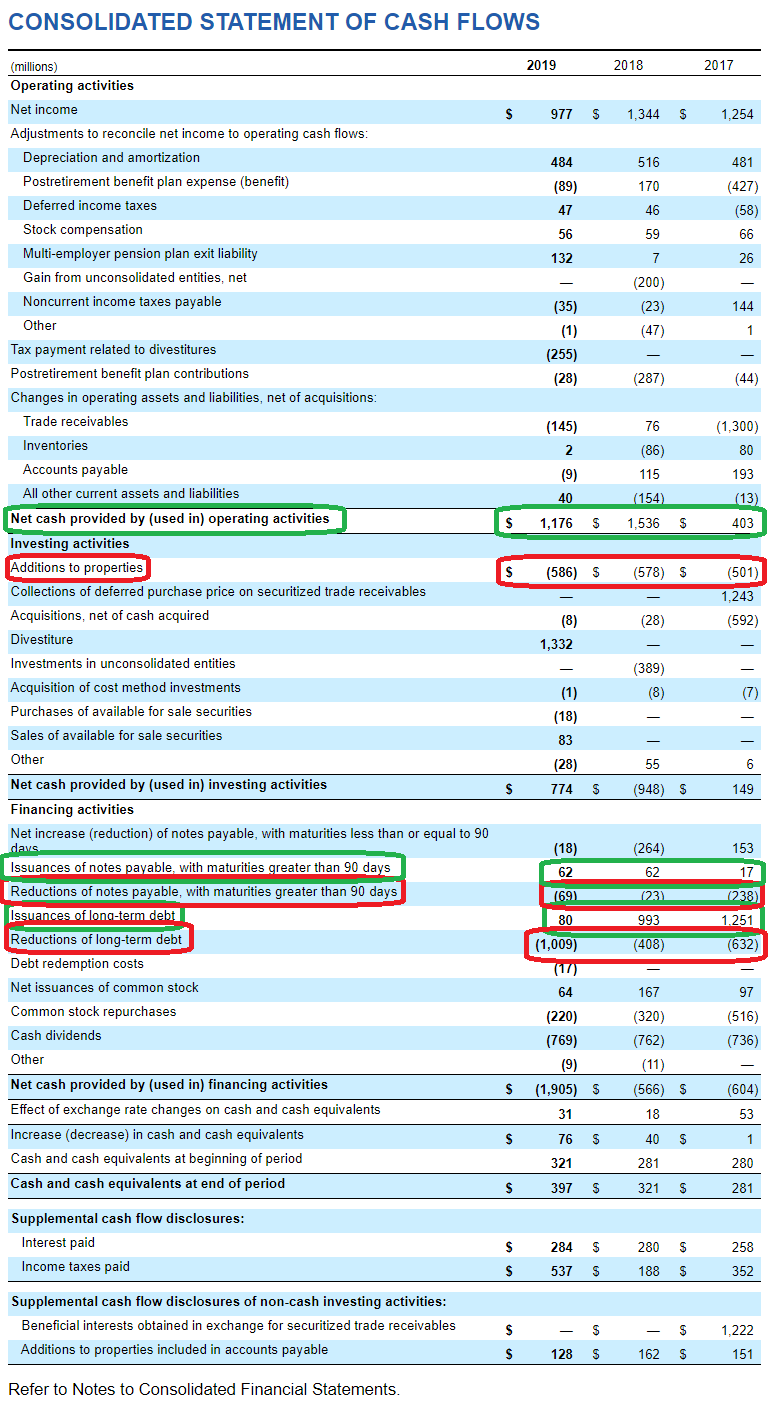

The calculation of FCFF begins with NOPAT which is a capital-structure neutral metric. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. As you can see LFCF provides you with a look at the present value of your company and an accurate depiction of your financial health.

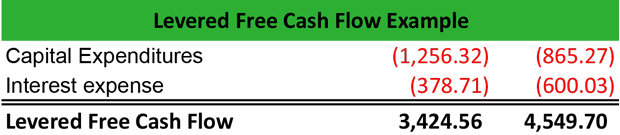

In short the levered FCF yield tells equity holders the amount of residual free cash flow allocatable to each unit of equity value. Weve established that LFCF represents money for stockholders after debt is paid. Levered free cash flow Net earned income - change in net working capital - mandatory debt payments - capital expenditures Once you collect all of this financial data and plug it into the Levered free cash flow formula you will determine your overall levered cash flow projection.

Levered free cash flow is relatively simple to work out although you will need to know a couple of key pieces of information beforehand. Multiply by 1 Tax Rate to get the companys Net Operating Profit After Taxes or NOPAT. Levered free cash flow is the amount of cash a business has after paying debts and other obligations.

Formula from Net Income Net Income FCFE. Levered free cash flow is calculated as Net Income which already captures interest expense Depreciation Amortization - change in net working capital - capital expenditures -. Free Cash Flow Net Income Interest Expense Interest ExpenseTax Depreciation Capex change in NWC 3c.

For FCFE however we begin with net income a metric that has already accounted for the. Levered Free Cash Flow. Free Cash Flow FCF Free Cash Flow to Firm FCFF Free Cash Flow to Equity FCFE How to calculate.

LFCF EBITDA - change in net working capital - CAPEX - mandatory debt payments. To arrive at unlevered cash flow add back interest payments or cash flows from. Levered and Unlevered Calculating free cash flow from net income depends on the type of FCF.

In contrast the formula for the levered free cash flow yield is the levered free cash flow divided by the equity value. Free Cash Flow EBIT 1-Tax Depreciation Capex change in NWC 3b So if we start with Net Income the whole formula for FCF is as folows. FCF NET INCOME NON-CASH EXPENSES CHANGE IN NET WORKING CAPITAL CAPEX.

Levered free cash flow is calculated as Net Income which already captures interest expense Depreciation Amortization - change in net working capital - capital expneditures -. Levered free cash flow formula. The equation for levered free cash flows is.

Levered free cash flow earned income before interest taxes depreciation and amortization - change in net working capital - capital expenditures - mandatory debt payments. The levered free cash flow formula is as follows. The formula to calculate the unlevered free cash flow for a company is the following.

Using Levered Free Cash Flow the formula is Net Income DA NWC CAPEX Debt. How Do You Calculate Unlevered Free Cash Flow. Therefore the levered free cash flow formula is.

Net Income to Free Cash Flow. Unlevered Free Cash Flow. Start with Operating Income EBIT on the companys Income Statement.

FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash Working Capital. Abbreviated it looks like this. FCF OPERATING CASH FLOW CAPEX.

Using Unlevered Free Cash Flow the formula is Net Income Interest Interest tax rate DA NWC CAPEX. Levered FCF Cash from Operations Capex Debt Principal Repayments Net. LFCF net income depreciation amortization change in net working capital capital expenditures mandatory debt payments.

The LFCF formula is as follows.

How To Use Levered Free Cash Flow And Revenue Growth To Analyze Stocks Seeking Alpha

Levered Free Cash Flow Lfcf Lumovest

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

What Is Free Cash Flow Calculation Formula Example

Free Cash Flow Fcf In Financial Analysis Magnimetrics

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

Paper Lbo Example Walk Through For Pe Interview Standard

Discounted Cash Flow Analysis Street Of Walls

What Is Levered Free Cash Flow Definition Meaning Example

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Levered Free Cash Flow Formula Explained Should I Use It For My Dcf

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Free Cash Flow Calculation Formula Example

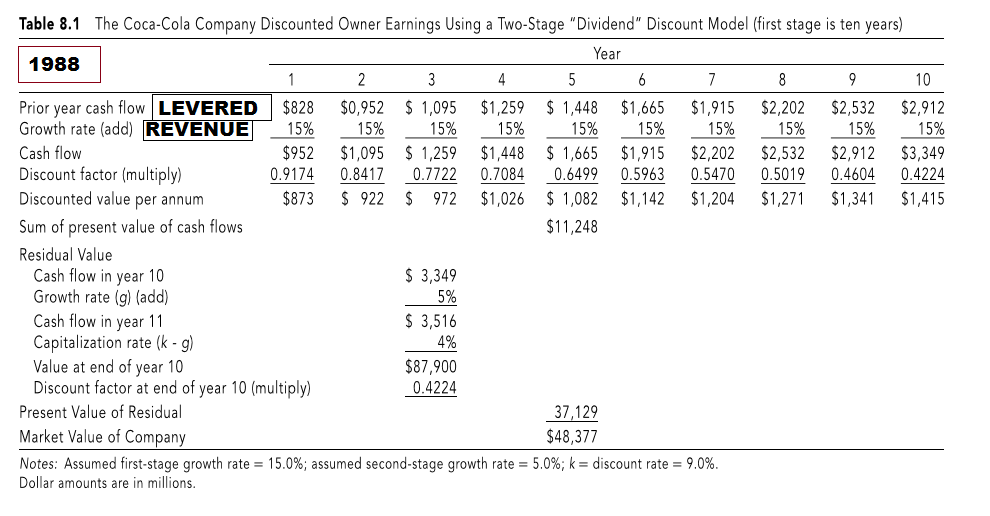

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Unlevered Free Cash Wave Accounting

Discounted Cash Flow Analysis Street Of Walls

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Post a Comment for "Levered Free Cash Flow Formula Net Income"